Risk Simplified

The resources for your financial institution to understand and manage risk in the modern business environment.

Join Blackice Today!

Information is not knowledge. The source of knowledge is experience. You need experience to gain wisdom.

- Albert Einstein

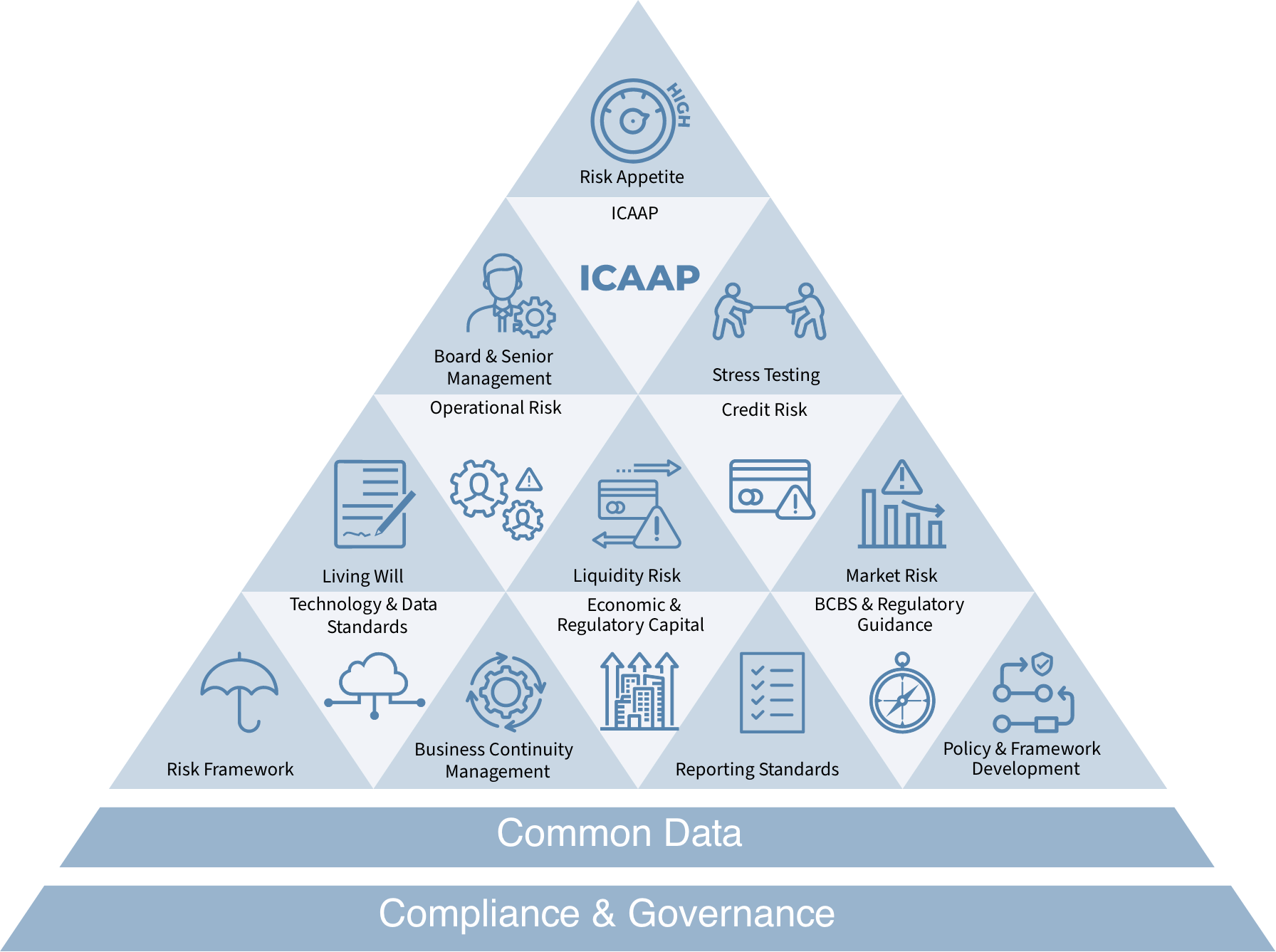

Services in an all-in-one platform to support:

Basel Compliance

Banking Risk Data Warehouse

Data Governance

Banking Policies and Procedures

Components

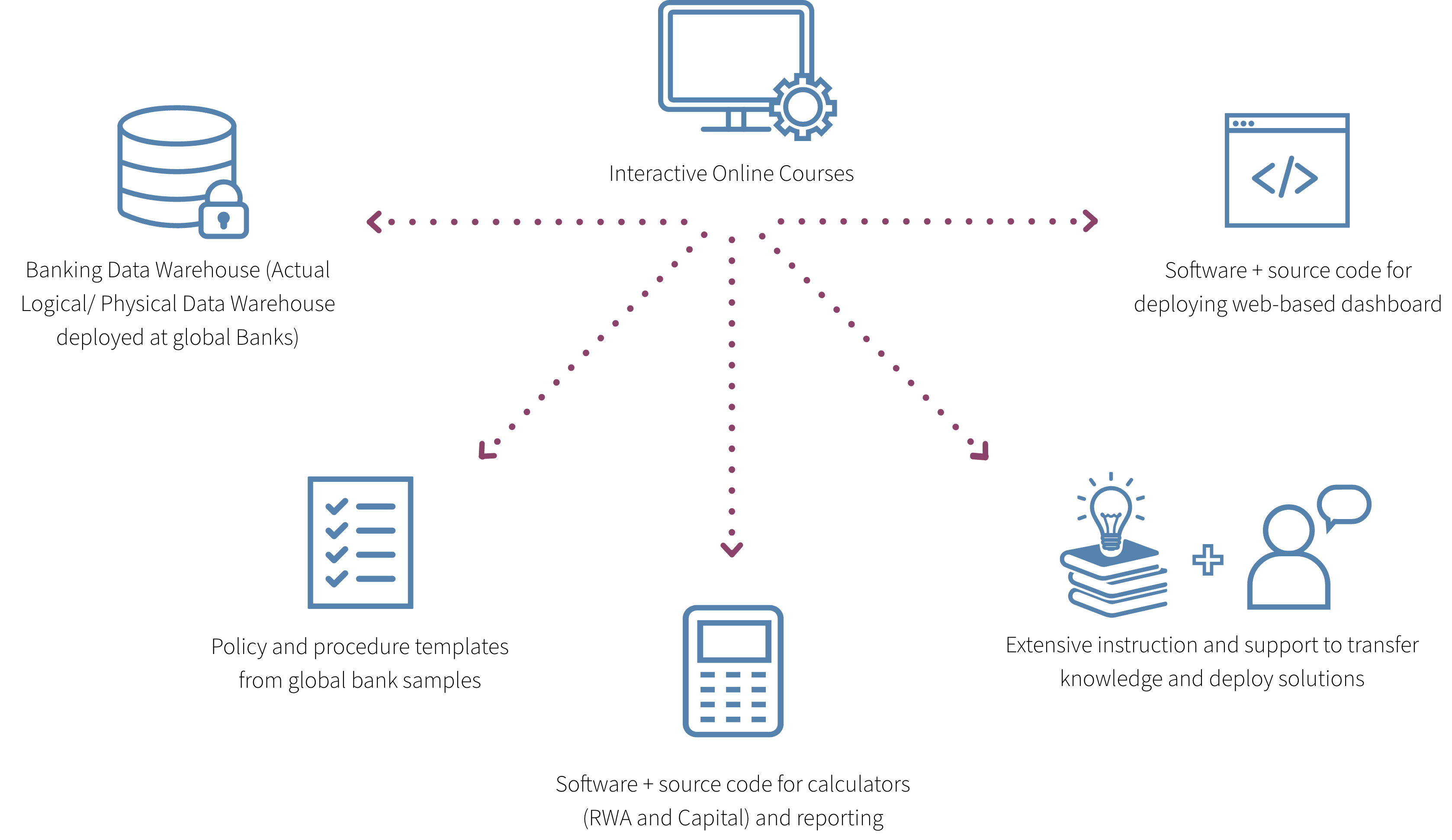

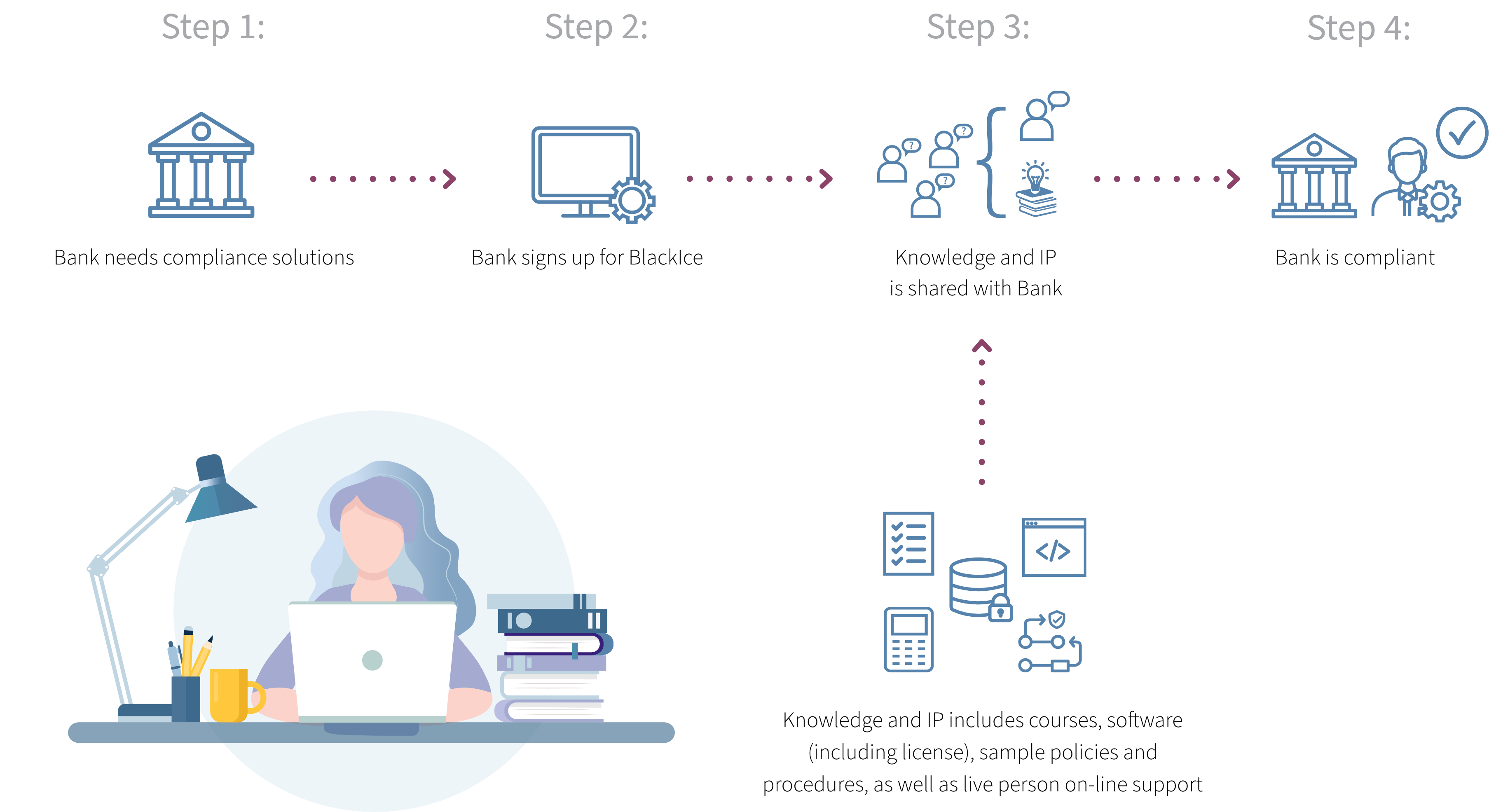

How does it work?

State Bank of Vietnam (SBV) including Circular 41/2016/TT-NHNN and Circular 13/2017/TT-NHNN

Financial Accounting Standards Board (FASB) Current Expected Credit Loss (CECL)

International Financial Reporting Standards (IFRS) Measure Financial Assets and Liabilities (9)

Industry Best Practices

BlackIce online, live person support

All documentation and courses translated into Vietnamese

Community chat rooms with other banks

Shared knowledge base and experiences

Services in an all-in-one platform to support:

Our team has worked with some of the world’s leading financial institutions and financial technology vendors.

Who are we?

BlackIce is a boutique advisory firm of senior practitioners, providing risk management and compliance guidance solutions to global financial institutions for 20 years.

This knowledge base, along with the solution source code and all elements for deploying the solutions are now available in an online course format.